B2B debt collection by Atradius Collections

We combine global reach with local expertise to help you recover debts while maintaining positive customer relationships.

/Banners/woman-shakes-hand-of-man.jpg/jcr:content/woman%20shakes%20hand%20of%20man.jpg)

At Atradius Collections, we are committed to being transparent with you about our debt collection process.

After sending a Final Demand Letter, you simply can start a debt collection case with us. Upload your unpaid invoices, monitor our collection process, and receive your money as soon as the debt is recovered.

- Tell us about your company

- Give us your debtor's details

- Upload your documents: invoice(s), correspondence, contract(s), etc.

Once these steps are completed, collection activity will begin on your debt collection case. Your contract is automatically generated and e-mailed to you*

* If you don't see the message from us in your inbox, check your spam or junk folder and mark our email address as secure. You will therefore receive emails about your debt collection case in the future.

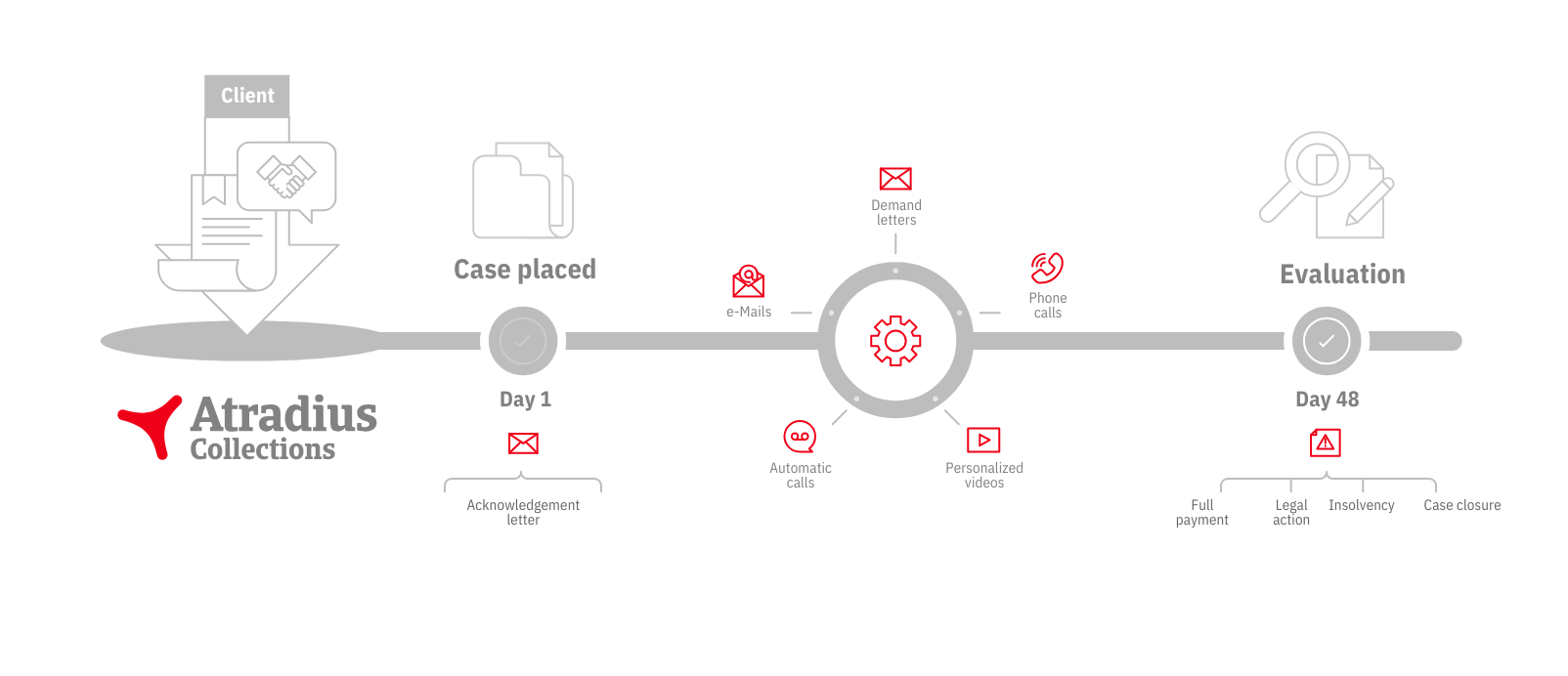

How does Atradius Collections work Debt Collection

Correspondence frequency depends on case value and our expert advice.

Everything you need to know about debt collection process

How do Credit-IQ and Atradius Collections recover outstanding debts?

We recover outstanding debts with a number of approaches. These include letters, emails, and calls used as part of our amicable collection process. The sequence of our letters and calls varies per country, based on Atradius Collections' experience of what is most effective in the region. We also attempt to find additional information and trace the debtors to get in contact. Our first reminder is sent within 48 hours upon receipt of a new collection case. For some countries, we visit the debtor's premises at an additional expense and if the amicable collection process is not successful, our professional collector will assess the case for legal action. This recommendation is based on the debtor’s financial status, debt age, estimated cost of legal action, available documentation, and chance of success. Legal charges are an additional expense. Please click here for more information on our debt collection process

What information do I need to provide when uploading a case?

When you place a debt collection case with us, we request as much information as you can provide. We usually need invoices and contracts, but also statements of accounts and the debtor's correct contact information.

What is the minimum debt amount that can be collected?

From our experience, debt collection cases that are lower than £250 are not cost-effective for your business as well as Atradius Collections. It is also proven that debts that are older than 36 months are harder to collect, and again unfortunately not cost-effective. You should ensure that it is economical for you to place the case given our file set-up fee which varies depending on the location of your debtor. The amount of the debt also determines the success fees that we charge. See our terms and conditions

Can I upload multiple invoices for the same debtor?

Yes, you can. You will be asked to upload your documentation when uploading your case online. If you discover more documents to upload after submitting your case, please log in and upload via the dashboard.

How do I get updates on my case?

To obtain updates on your case, we will automatically update the online platform every time an action is taken on the case. When a new update is available, you can log in on to view the status of your case using your Credit-IQ credentials. You can also message your case handler for an update via the online platform.

How long does it take to handle a collection case, on average?

It usually takes about 90 days to handle an amicable collection case. This can vary depending on the communication status with the debtor. If the amicable phase yields no results, we will recommend further action.

How does a debtor pay the debt they owe?

Credit-IQ and Atradius Collections are authorised by you to collect the debt when you place a case with us. The debtor will be asked to make payment to an Atradius Collections' bank account. We then deduct our fees before making payments to our clients.

When do you advise taking legal action?

If the amicable collection process is not successful, our professional collector will assess the case for legal action. This is based on the debtor’s financial status, debt age, estimated cost of legal action, available documentation and chance of success.

What costs and timelines are associated with legal action?

We require a retainer from our clients before sending a case for a legal review. The timeline and costs of legal action will differ per debtor's country and the size of the debt. It is your decision to proceed with legal action and thus bear its costs.

Learn more about our debt collection fees

What fees do you charge on successful collections?

Upon successful collection, our success fee is charged on the amounts collected. This fee is dependent on the location of your debtor. An extra 2% commission will be charged on top of the standard collection fee for invoices that are 180+ days overdue. This will also be reflected in your quote which you can retrieve on our terms and conditions.

If you collect costs and interest, are these returned to us?

We apply costs and interest at the statutory rate based on the debtor's country’s respective laws. If we collect costs and interest on a domestic case (where the debtor is based in the UK), this will be returned to yourselves. However, we retain costs and interest on export cases.

Would I be charged if I withdraw a case during the collection process?

If you choose to withdraw a case against our recommendation during the collection process, a withdrawal fee may apply. However, you can choose to close the case at the end of our amicable collection phase at no cost. It usually depends on the case and its status.

What costs are associated with legal action?

The timeline and costs of legal action will differ per debtor's country and the size of the debt. We require a retainer from our clients before sending a case for a legal review. It is your decision to proceed with legal action and thus bear its costs.

My debtor made a payment just after I placed a collection case with you. Do I still need to pay the fees?

Should your debtor make a payment just after you have placed your collection case with us, you are still obligated to pay our collection fees. You become a customer as soon as you place a case with us, and as such our professional collectors start work immediately.