Why Credit-IQ is the premier Accounts Receivable management solution for modern businesses

Businesses facing overdue payments and inefficient manual accounts receivable (AR) management suffer from strained cash flow, wasted resources, and frustrated teams. As operations scale, these issues worsen. This article offers effective and user-friendly solutions to these challenges.

/article-photos/shutterstock_2295886607.jpg/jcr:content/shutterstock_2295886607.jpg)

Enter Credit-IQ, the game-changing platform designed to automate and streamline AR processes, freeing up time and resources to focus on growth. With features that simplify payment reminders, invoice tracking, and financial reporting, Credit-IQ empowers businesses to take control of their cash flow with minimal effort.

In an extensive Credit-IQ review conducted by Research.com, the AR platform received glowing assessments for its exceptional usability, robust automation tools, and measurable impact on AR performance. The platform’s deep integration capabilities and intuitive design earned high marks, positioning it as a trusted choice for businesses of all sizes.

Credit-IQ is a cloud-based accounts receivable management platform designed to help businesses get paid faster and maintain healthy cash flow. By automating key AR tasks like payment reminders, invoice tracking, and final demand letters, Credit-IQ reduces the time and effort required to follow up on outstanding payments.

Key Features that Set Credit-IQ Apart

Credit-IQ offers a suite of features tailored to meet the diverse needs of businesses:

Automated Reminders: Chasing payments is a thing of the past. Reminders are sent in the background, guaranteeing timely payment without any effort on your part.

Customizable Workflows: Get pre-set reminders in 8 languages that match your business processes, branding, and markets—or build your own from scratch.

Centralized Tasks: No more scattered to-do lists and disjointed systems. Credit-IQ brings your team's accounts receivable tasks under one roof, making managing and staying on top of payments a breeze.

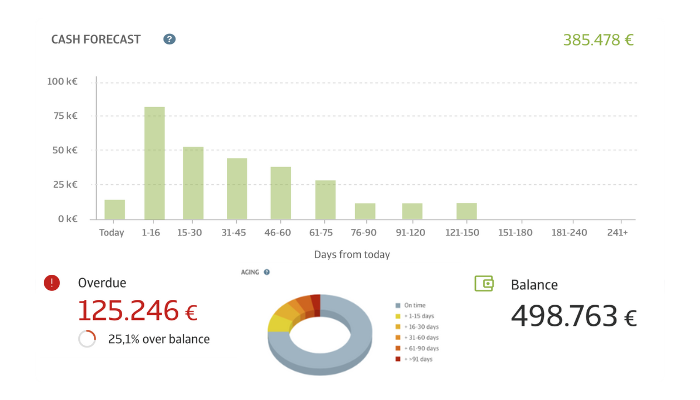

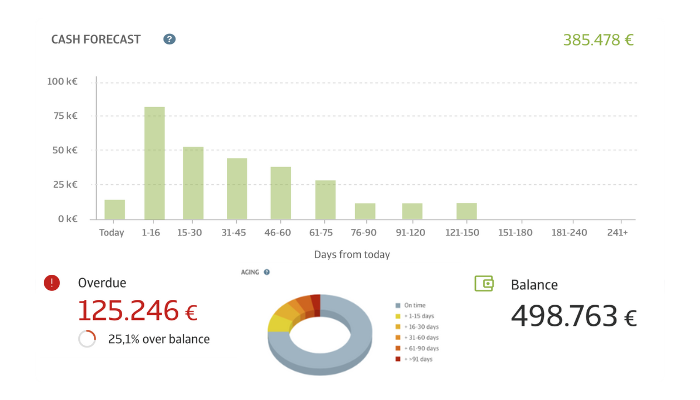

AR Overview: Intuitive dashboards give a bird's-eye view of your AR portfolio, helping you to visualize key metrics, spot trends, and identify areas to boost your bottom line.

Seamless Integrations: Credit-IQ easily integrates with whatever software you’re using to manage your daily tasks, supporting tools like FreshBooks, NetSuite, Sage One, Microsoft Dynamics, and more.

/article-photos/CRM.png/jcr:content/CRM%20(1).png)

.png)

Why businesses rely on Credit-IQ

In an era where efficiency and automation are paramount, Credit-IQ provides solutions that address common AR challenges:

Time Savings: Automating the collection process reduces the time spent on manual processes. Credit-IQ includes pre-set workflows and reminders, which you can customize to fit your brand, tone of voice, and customer language.

Improved Cash Flow: Increase the likelihood that customers will pay. Credit-IQ is powered by Atradius, meaning you can include a final demand letter into your workflows. Following that, they’ll handle the debt collection process for you.

Enhanced Financial Oversight: Managing cash flow has never been more vital. Credit-IQ plugs into your bookkeeping software and provides dashboards and reports that give you the complete AR picture.

Why Businesses Use Credit-IQ

Credit-IQ offers tangible benefits that positively impact daily operations and long-term financial health:

AR Efficiency and Productivity: By automating reminders and centralizing tasks, Credit-IQ enables teams to focus on strategic activities rather than repetitive follow-ups.

Scalability: With customizable workflows and support for multiple languages, Credit-IQ adapts to the evolving needs of growing businesses.

Professionalism: Automated, branded communications ensure consistent and professional interactions with clients, enhancing business reputation.

/Banners/with-ciq-(sharp)-min.png/jcr:content/Logo%20(2).png)

.png)

Credit-IQ in Today’s Business Landscape

Credit-IQ's innovative approach to AR management has garnered attention in the financial software industry. Considered one of the best accounts receivable software today, its user-centric design and automation capabilities have been highlighted in various reviews, positioning it as a top choice for businesses seeking to optimize their accounts receivable processes.

As the demand for automation and digital transformation grows, tools like Credit-IQ are becoming indispensable. Whether you are a small business owner seeking to simplify your invoicing process or a larger organization looking to reduce administrative burdens, Credit-IQ offers a scalable and efficient solution tailored to meet your needs.

The importance of efficient accounts receivable management has grown as businesses increasingly rely on technology to enhance financial oversight and operational efficiency.

According to a McKinsey report, while 98% of CFOs acknowledge their finance teams have invested in digitization or automation, only 41% report that less than a quarter of their finance processes are currently digitized or automated. This discrepancy suggests a significant gap between the recognized need for digital transformation in finance and the actual level of implementation.

Credit-IQ is perfectly positioned to address this gap, offering not only automation but also customization and integration to bookkeeping software and other systems that cater to a wide array of industries.

By eliminating the manual effort of chasing payments, Credit-IQ enables businesses to allocate resources more effectively, focusing on growth and customer satisfaction. The platform’s ability to integrate with popular bookkeeping and ERP systems further underscores its value as a seamless addition to existing financial processes.

The Future of AR Management with Credit-IQ

Credit-IQ is not just a tool for the present; it is designed to evolve alongside the needs of its users. The platform continually updates its features to incorporate new technologies and respond to user feedback. Future developments, such as AI-driven analytics and predictive payment trends, are likely to make Credit-IQ even more indispensable for businesses looking to stay ahead in a competitive market.

The company’s commitment to innovation is also reflected in its partnerships with leading financial service providers. These collaborations ensure that Credit-IQ users have access to the latest advancements in AR management, from enhanced security protocols to more efficient payment processing systems

.png)

Why Choose Credit-IQ?

In a crowded market of AR management tools, Credit-IQ differentiates itself through its focus on simplicity, scalability, and results. Here’s why businesses are choosing Credit-IQ over traditional AR solutions:

Proven Impact: Credit-IQ's users report a significant reduction in days sales outstanding (DSO) and an improvement in cash flow within just months of implementation.

Customer Support Excellence: With a dedicated support team available to assist with onboarding and troubleshooting, Credit-IQ ensures a smooth user experience from day one.

Transparency: The platform provides detailed reporting that gives businesses a clear view of their AR metrics, fostering informed decision-making and strategic planning.

Experience the Credit-IQ Advantage

In conclusion, Credit-IQ stands out as a premier accounts receivable management platform, offering a comprehensive suite of features designed to automate and enhance AR processes. Its user-friendly interface, customizable features, and seamless integration capabilities make it an essential tool for businesses aiming to streamline their financial operations and maintain positive cash flow.

If your business is looking to take control of its accounts receivable and optimize cash flow, there’s no better time to explore Credit-IQ. With its powerful automation tools, intuitive design, and commitment to delivering measurable results, Credit-IQ is the ultimate solution for modern AR management.

Start your free 30-day trial today and discover how Credit-IQ can transform the way you manage your accounts receivable. Visit Credit-IQ to learn more and see why businesses across the UK are choosing Credit-IQ as their trusted partner in financial success.

/article-photos/reporting.png/jcr:content/reporting%20(1).png)

/Banners/with-ciq-(sharp)-min.png/jcr:content/Logo%20(2).png)

How much time are you losing?

See Credit-IQ in action. Start free trial now